For centuries, real estate investing has been a popular wealth-building strategy, and for good reason. In fact, over 90% of all millionaires have leveraged real estate to build a majority of their wealth. Real estate is a tangible asset that can provide steady income and long-term appreciation. However, as with any investment opportunity, timing is critical. Knowing the right time to buy and when to hold is essential to building wealth through a real estate portfolio.

A buyer’s market is one of the best times to find value in real estate. In a buyer’s market, there is an oversupply of homes for sale, and buyers have the upper hand in negotiations. This can lead to lower prices, better deals, and more options for investors looking to add to their residential and commercial portfolio. Many real estate experts believe that rising interest rates will trigger a buyer’s market in the near future forcing sellers to competitively price their homes. Now is the best time to prepare yourself to take advantage of the changing market conditions.

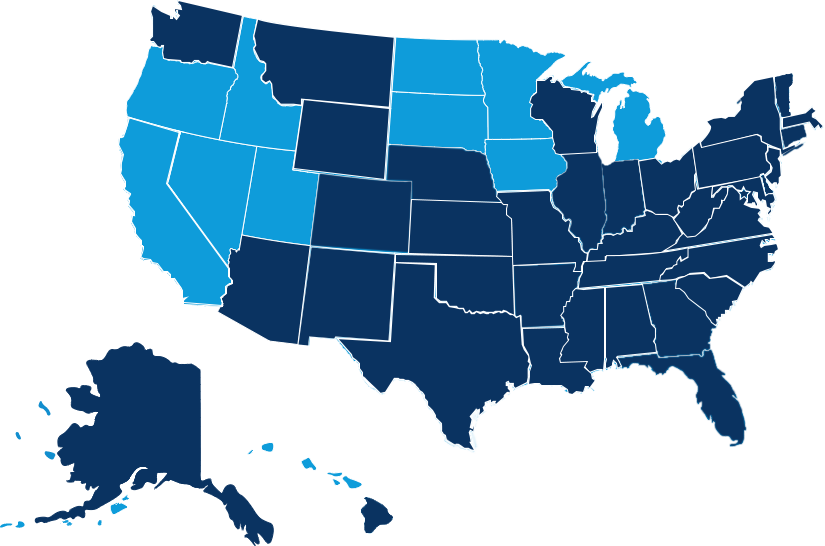

The first step is to understand the current market conditions. Real estate markets can vary widely by region, so it’s important to do your research and keep a close eye on local trends. Look for signs of a buyer’s market, such as an increase in the number of homes for sale, longer days on market, and declining prices. Speaking to a qualified real estate advisor will give you a sense of market conditions and any upcoming developments that may impact supply and demand.

The next step is to ensure that you have your financing in order and ready to move quickly when the right opportunity presents itself. Waiting until you find the perfect property before starting the pre-approval process for financing may be too late. Instead, you should work with an advisor who understands your financial situation and can make appropriate recommendations for structuring a financing package that makes sense for you. This may include exploring options for creative financing, such as seller financing or private loans.

In addition to having your financing in order, it’s important to have a solid investment strategy in place. This means understanding your investment goals, your risk tolerance, and the specific market conditions in the areas where you plan to invest. It may also mean developing a diversified portfolio that includes a mix of residential and commercial properties, as well as different types of properties in different geographic locations.

A knowledgeable advisor can also help you spot the potential for value-add opportunities. In a buyer’s market, there may be more distressed properties available, such as foreclosures or short sales. These properties may require some work to bring them up to market standards, but they can also offer significant upside potential in terms of value appreciation and rental income. However, it’s important to carefully understand the risks involved in a value-add project.

Finally, successful investors must have a long-term plan when investing in real estate. Real estate is not a get-rich-quick scheme. It requires patience, persistence, and a willingness to wait out market cycles. By investing in a buyer’s market, you can position yourself to build long-term wealth through steady rental income and appreciation over time.

Ultimately, a buyer’s market can offer significant opportunities for real estate investors looking to build wealth through property investment. At Market Financial, it’s our goal to make sure you are prepared to act quickly by evaluating the investment strategy and recommending the right approach to financing tailored to your situation. We look forward to working with you to build a successful and profitable real estate portfolio.